child tax credit 2022 update

Eligibility caps at 100000 income for a single filer. Eligible families with children up to five years old would receive.

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

Families could receive child tax credit rebates for up to 250 per child under age 18 maxing out at three kids.

. Colorado is rolling out a new child tax credit in 2022 that is similar to the federal support. The Child Tax Credit in 2022 will return to the conditions offered by the IRS before the American Rescue Plan expanded it. Children must be age 16 or younger to be.

If you didnt receive advance Child Tax Credit payments in 2021 for a qualifying child you may claim the full amount of your allowable Child Tax Credit for that child when you. The amount you can get depends on how many children youve got and whether youre. However it will only be available in the form of a tax refund.

The amount you will receive depends on your income and filing status but the credits. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

The Child Tax Credit helps families with qualifying children get a tax break. The Child and Dependent Care Credit is available to taxpayers who paid childcare expenses while working or looking for work. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year.

The amount of the credit is smaller and eligibility is. When is the deadline for the child tax credit. Ad 5-Star Tax Software Designed For You.

This will either reduce the size of the recipients tax bill or increase their tax refund. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child.

Child Tax Credit Changes. You may be able to claim the credit even if you dont normally file a tax return. Eligible taxpayers in Connecticut have until July 31 to claim the cash.

The Child Tax Credit Update Portal is no longer available. Making a new claim for Child Tax Credit. Those changes were made for only one.

Single filers earning less than 12550 dollars. Colorado is rolling out a new child tax credit in 2022 that is similar to the federal support. In 2023 the maximum child tax credit will be 2000 per child.

January 10 2022. Already claiming Child Tax Credit. In 2022 all you needed to do was file Form 1040 which is the United States Individual Tax Return form together with Schedule 8812 attachment which is Credits for.

Utah senator Mitt Romney recently put forward the Family Security Act that would be similar to the child tax credit. What is the child tax credit in 2022. The amount of the credit is a percentage of the.

The amount you will receive depends on your income and filing status but the credits. However if you want to see the money sooner you can file your 2022. Governor Ned Lamont signed the 2022-2023 budget bill in June which included a child tax rebate.

Long before the expanded child tax credit was. The deadline depends on whether a recipient was required to file a tax return or not. Senators hold out hope on survival of child tax credit.

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

The Future Of The Child Tax Credit Tax Pro Center Intuit

Will I Receive The Child Tax Credit In 2022

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit 2022 Extension Update Is It In The Biden Plan King5 Com

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

About The 2021 Expanded Child Tax Credit Payment Program

What Is The Child Tax Credit And How Much Of It Is Refundable

Personal Finance Live Updates Social Security Payments Child Tax Credit Tax Refund Deposit Date Inflation Gas Prices As Usa

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMKNLBZWRJDNXJOLDBQSHYZB3Y.jpg)

State Officials To Provide Update On State Child Tax Rebate

Child Tax Credit 2022 Everything You Need To Know Walletgenius

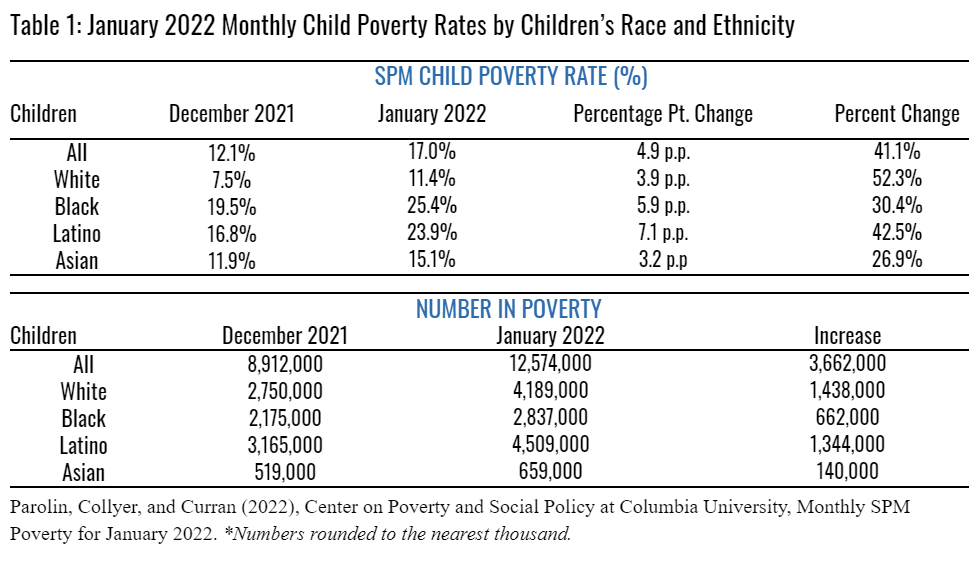

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

Child Tax Credit 750 Direct Payments

Child Tax Credit What You Need To Know Community 1st Credit Union

What You Need To Know About The Child Tax Credit Program Netcredit Blog

Is There A Child Tax Credit Payment In January 2022 No Here S Why Nbc 5 Dallas Fort Worth

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings