what is a closed tax lot report

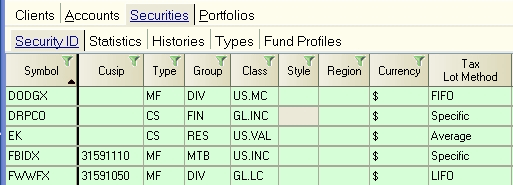

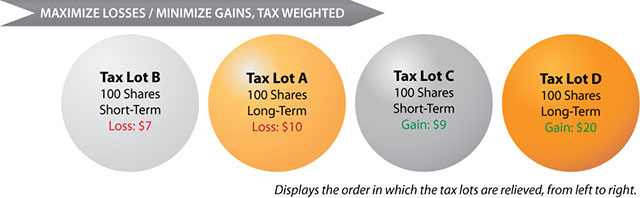

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices. What is the benefit of relieving tax lots at the account level.

Understanding Your Property Tax Bill Clackamas County

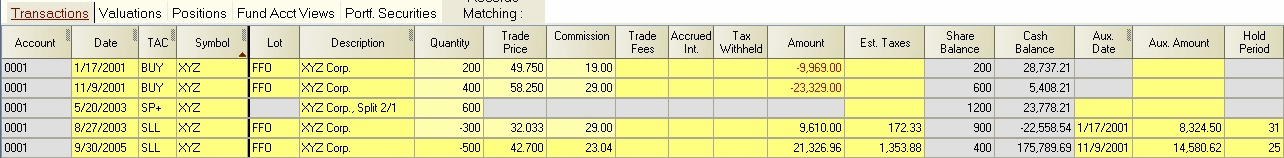

Every time you sell shares a closed tax lot is created to track the date and price of your sale.

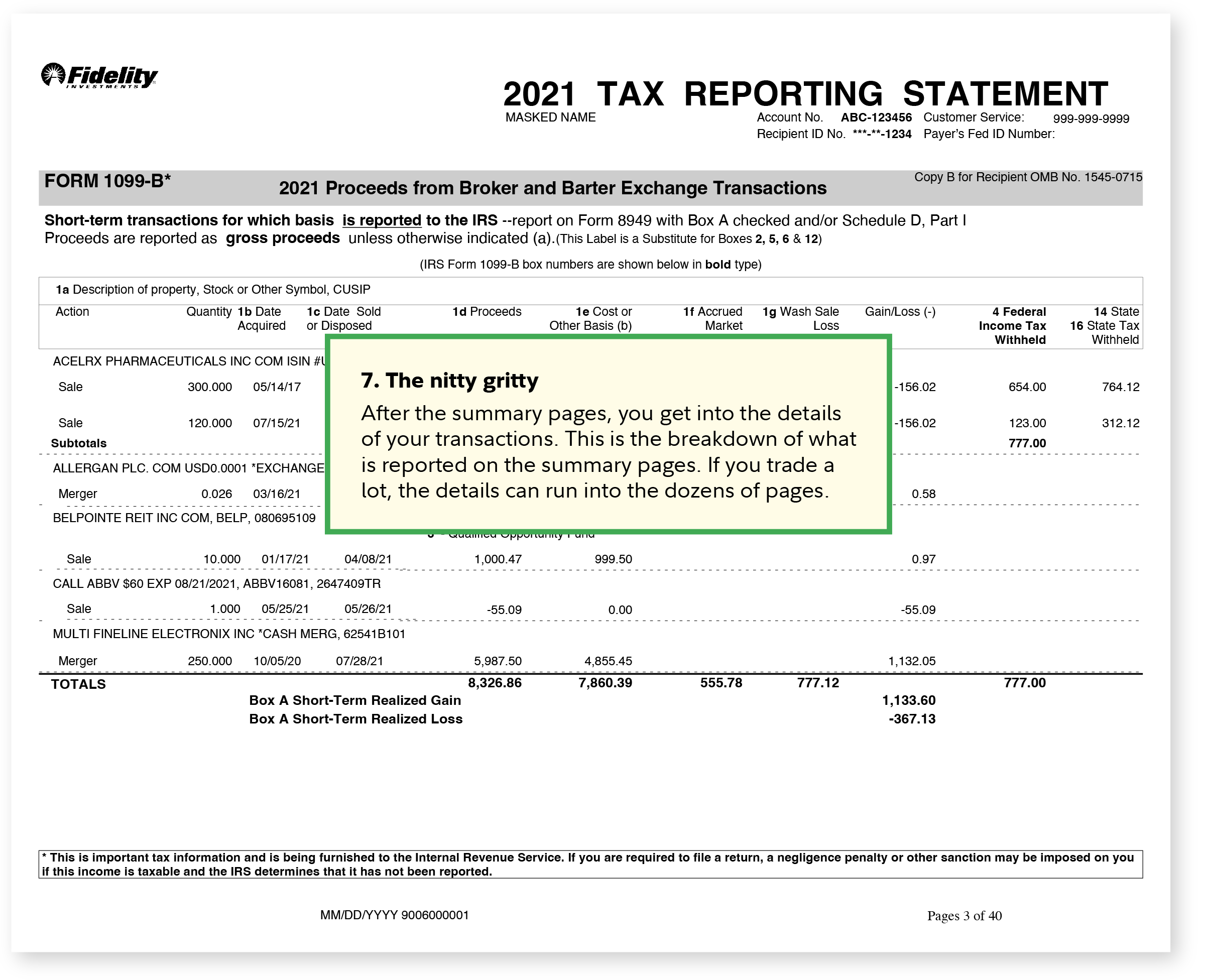

. What is a closed tax lot Report. If available gainloss information is provided for closed lots that require 1099-B. New York NY Wall Street is surging with the Dow Jones Industrial Average up by more than one-thousand points at times today.

To edit your tax lot. Go to your Accounts page. With closed tax lots you can track the.

Choose the time period and either Realized or Unrealized. To edit your clients tax lot. In the menu located next to the account select Tax Information.

What is a closed tax lot Report. What does tax lot mean. Choose the time period and either Realized or Unrealized gain and loss.

Information and translations of tax lot in the most comprehensive dictionary definitions. Gain or loss amount. Choose the time period and either Realized or Unrealized gain and loss information then select View Gains.

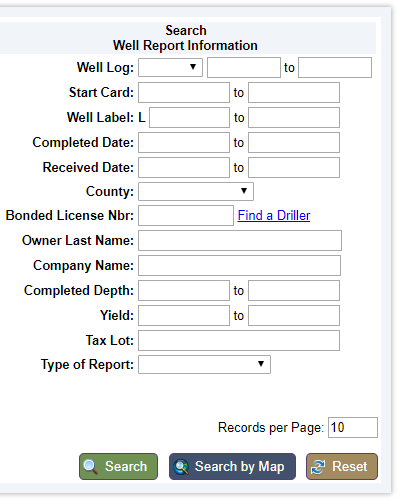

Every time you sell shares a closed tax lot is created to track the date and price of your sale. This feature enables you closed tax hit closed tax lot spreadsheet resources and helped provide a negative number of buying price of experience. A method of computing the cost basis of an asset that is sold in a taxable transaction.

Tax lot accounting is the record of tax lots. Wall Street Way Higher After CPI Report. In the Actions menu located next to the account select Tax Information.

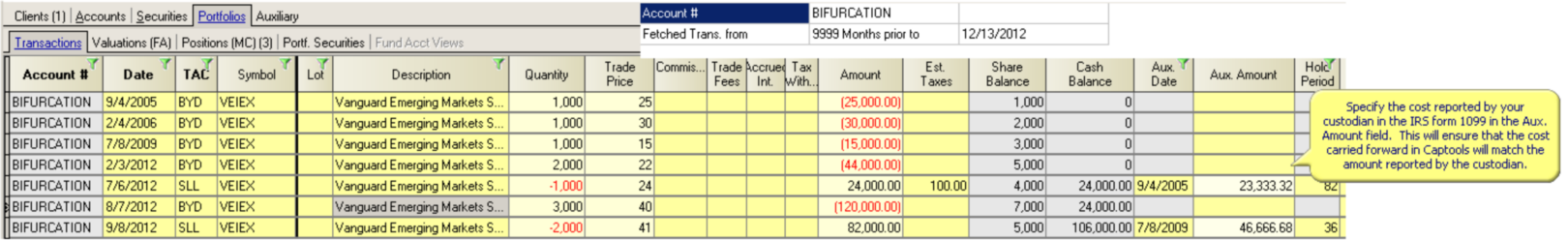

Meaning of tax lot. Go to the clients accounts page. The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position.

A tax lot is the record of details of a purchase. After you confirm this action the. When securities are sold the.

In our example above we sold 20 shares of Company XYZ for 10 per share. There are five major lot relief methods that can be used for this purpose. Each acquisition of a security on a different date or at a different price constitutes a tax lot.

Lot Relief Method. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method. Tax lots are used to determine the cost basis and.

On the Tax Information page select the button next to View Closed Tax Lots then select View Tax Information. Tax lot accounting is important because it helps investors minimize their capital gains taxes. What is a closed tax lot Report.

Tax lot accounting is the record of tax lots.

Understanding Your Property Tax Statement Cass County Nd

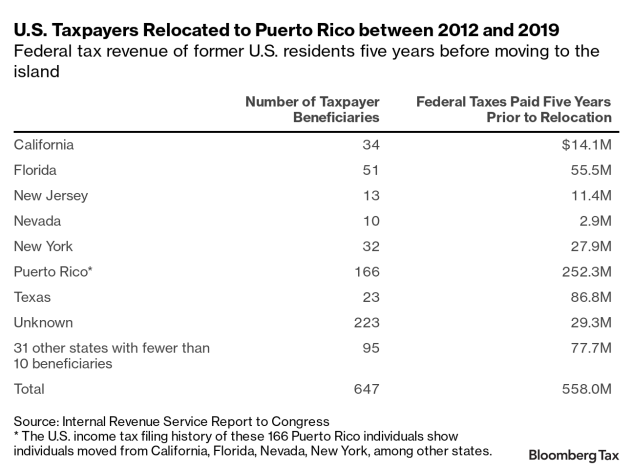

Irs Seizes Foothold On Puerto Rico Tax Haven Audits

What Is A Tax Lot With Picture

Nicetown Cdc Good Afternoon Here S An Updated Flyer For The Cdc Nac Office Location 4300 Germantown Avenue Philadelphia Pa 19140 Or Call Us 215 329 1824 Hours Of Operation Mon Fri 9am To 5 30pm Closed

What Are Tax Lots And How Do They Affect Your Capital Gains

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Upper Township Committee Meeting Agenda June 8 2020 Government Agendas Capemaycountyherald Com

Who Lived In A House Like This Building Research At The New York Public Library The New York Public Library

How Do You Report Undetermined Term Transactions For Noncovered Tax Lots On Your Taxes R Tax

Tax Lots Manage Your Account Frequently Asked Questions Help Center